Is semi-retirement the new retirement?

September 11, 2021

Don’t just plan to retire, retire with a plan

September 11, 2021Learn about new investment opportunities and how to understand your risk profile when planning your investment strategy.

It is almost impossible to miss the headlines these days about the next new investment idea. Chances are those new ideas are likely related to digital assets (e.g. cryptocurrencies) or online funding intermediation (e.g. peer-to-peer lending or equity crowd funding) and the like. These options seem to be the most attention- grabbing ones, attracting both seasoned and novice investors alike. This begs the all-important question – are these investments suitable for you?

To help us get a grip on this question, let us briefly take a look at what each of these alternative investments are, how it works and how can you benefit from it.

1. Digital currencies (a.k.a. cryptocurrencies)

Digital currencies as the name suggests are an alternative means of a financial exchange in a non-physical format. This is unlike fiat currencies that are government issued and regulated such as the US dollar, British pounds or our own local currency – the Malaysian ringgit. Among digital currencies, Bitcoin remains the most well-known and sought after.

The rise (and fall) in value of digital currencies has been nothing short of phenomenal. However, apart from scarcity, it would seem that speculation (partly fueled by celebrity tweets) and regulatory risks seem to be main drivers of price movements for now. This could change as digital currencies start to gain a foothold as a medium of exchange, potentially replacing fiat money in the future. For now, an investor will monetise any returns by selling the investment, hopefully at a profit.

2. Peer-to-peer (P2P) lending

As the term suggests, this involves the lending of funds between individuals, supported by a platform as an intermediary to facilitate the process. It is effectively a way of cutting off the middleman’s role which has long been played by financial institutions.

In P2P lending, also known as “social lending”, investors are offered a socially attractive value proposition by borrowers who might otherwise find it challenging to fund their enterprise via traditional channels. Investors receive returns in the form of interest payments at the end of the loan period. Given that these often represent higher risk lending, the interest payment will likely be higher than bank fixed deposit rates.

3. Equity crowdfunding (ECF)

ECF works similarly to P2P lending in that it provides an alternative source of funding for budding companies. However, the main difference is that ECF investors will receive a stake in the business instead of an interest payment. This might be an attractive proposition for those looking to discover the next unicorn investment. However, investors should also be aware of their exit strategy before committing their hard-earned money.

Now that we have some high- level idea about these alternative investments – are they right for you? Instead of limiting your analysis to the investment idea itself, I would suggest that the question is better answered by firstly determining your investment risk profile, followed by your ideal strategic asset allocation. Only then should one take the plunge to invest.

Investopedia defines risk profile as “an evaluation of an individual’s willingness and ability to take risks”. Are you a risk taker by nature, fully aware of how investment values fluctuate depending on market condition and are ready to ride out any storm that come your way? Or are you the more conservative type – preferring to err on the side of caution by placing your hard-earned money in risk-free assets?

Secondly, how long can you remain invested? If you need to use the fund in the next one to two years, then investments should not be on your mind. However, if your investment duration is between three to five years, perhaps you can consider moderate risk rated investments. If your funds can remain invested for over five years, then you are in a better position to weather the ups and downs associated with higher risk assets.

Answering these two questions will give you an idea of your risk profile – conservative, balanced or aggressive. Next, you should determine your ideal asset allocation. The strategic asset allocation is a breakdown of your investment allocation into three simple investment asset classes – low risk, moderate risk and high risk.

Low risk assets would comprise of risk-free assets that hold their values and likely have a pre-determined rate of return. Examples would includedeposits place in financial institutions and government issued bonds like Malaysian government securities (MGS). Other fixed value assets with variable expected returns or those with minimal price fluctuations that fit this category include our Employees Provident Fund (EPF) savings, certain fixed priced Amanah Saham funds and low risk fixed income securities like money market funds or capital protected products.

Moderate risk assets on the other hand have the potential of generating a higher variable return (e.g. between 4-6% p.a. above the risk free rate) and could comprise of assets such as blue chip dividend stocks or a balanced diversified portfolio consisting of shares and bonds. Property assets and REITs that offer both regular income and potential long-term capital appreciation can be categorised here as well.

Lastly, we have growth or high-risk assets that are made up of stocks in a diversified portfolio of expansion- focused companies, small to mid-sized businesses in developing countries, commodities and perhaps alternative assets such as private equity investments or collectibles like wine, luxury watches and paintings. These may fluctuate a lot more in value but offer potentially better long-term returns.

The list of assets above is obviously not exhaustive but will hopefully give you a sampling of assets by risk category that most people would consider investing in. The idea behind an asset allocation strategy is not so much about choosing one asset class over the other, but rather having most or all of these asset classes in your stable and in the percentage of allocation that reflects your risk profile.

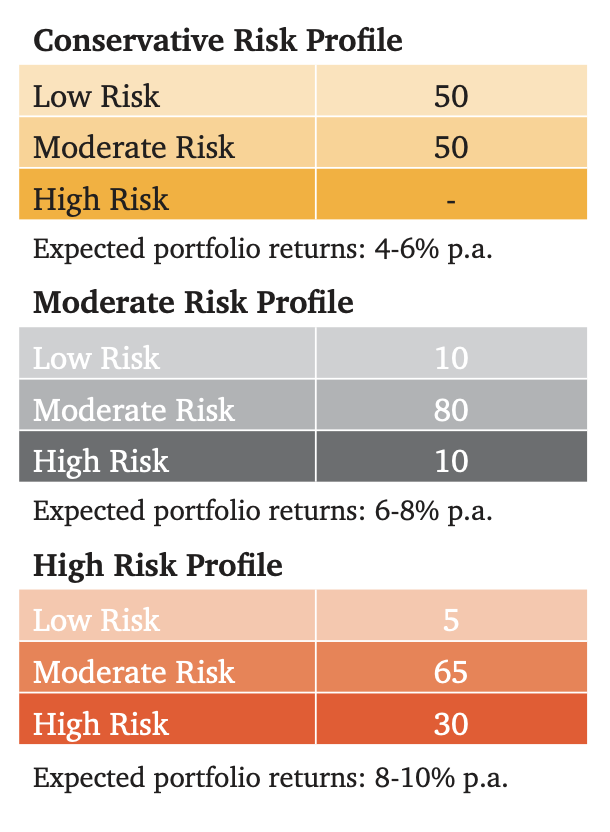

Let us look at a simple approach to asset allocation for one’s investable assets:

A moderate risk investor would probably place the bulk of his investable assets in moderate risk assets and only around 10% in the high-risk space. From this allocation, he should expect a blended overall return of around 6-8% p.a. As such, the strategic asset allocation gives you an idea on how you can select a combination of different assets classes and the corresponding expected returns on your overall portfolio.

Given the nature of these alternative investments at this juncture – where price discovery remains a challenge, volatility is high, and long-term values remain uncertain – it would be more appropriate to classify them as part of your high-risk investment bucket.

Back to the question of whether investing in those alternative assets in the examples given are suitable for you, firstly consider where it fits in based on the suggested strategic asset allocation.

Perhaps a 10% allocation in each of these strategies would be sufficient for most. In simple terms, this means roughly 1-3% allocation of one’s investable assets would be about right for the balanced to aggressive profile investor.

In conclusion, the next time you encounter an innovative investment option that comes across as the best invention since sliced bread, the first thing you need to do is to increase your knowledge and understanding of that product instead of signing the dotted line simply based on a herd mentality or the fear of missing out. Should you decide to proceed thereafter, then invest based on your ideal strategic asset allocation in linewith your risk profile. This golden rule should keep you in good stead for a long time to come.

First published in Smart Investor 07/08, 2021 Issue

Felix Neoh

Director of Financial Planning at Finwealth Management Sdn Bhd