HOW IT WORKS

You track your

income and expense in one app

KEY FEATURES

We bring together all of your accounts, so you can conveniently manage your finances from one place

Growing Your Overall Wealth

Most people approach investing by trying to maximise ROI (return on investment) based on their investment amount (capital). In Finwealth, we believe it is more important to understand the risks vs rewards and the expected return of an asset eg FD, stocks, bonds, FDs, and to determine the investment period of these assets eg short term, medium term, long term.

All investments come with a given level of risk (volatility factor) and the higher return you seek, you need to be prepared for the potential downside risk as well eg. If you aim for 20% return, you need to be able to withstand a 25%-40% loss.

What this means is that you don’t really need spectacular high returns (with high risks) to grow your wealth but rather a consistent compounding rate of return that is safer and let’s you sleep better at night not having to worry that your overall wealth has dropped by 50% overnight!

Therefore, our Focus will be more towards growing your overall wealth a.k.a Net Worth rather than trying to maximise return % on a (small) amount that has little impact to grow your wealth over the long -term.

How Do We Do This?

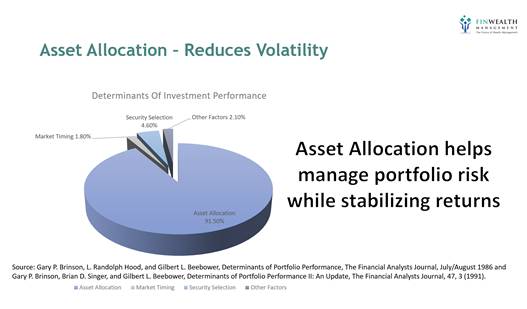

By constructing an asset allocation model to fit your individual risk profile. This will serve 2 purpose, manage your own level of fear/ greed and at the same time able to maximise your returns at a given level of risk. This way, we will be able to know how much of your wealth needs to be allocated to the low risk, medium risk and high-risk investments in order to provide you a good balance between maximising returns for a given level of risk.

It is proven that asset allocation and diversification

are the key determinants of long term investment performance.

Our Investment Process

- Understanding your Goals/ Objective

- Asset Allocation & Diversification based on your Risk Profile

- Active Performance Management

As we start understanding the objectives of your investments be it Cash reserves (emergency fund), down-payment for a property/car, secondary/tertiary education funding, annual vacations, retirement etc, we will be able to better allocate your investments according to your goals. This will also help motivate you to save and invest your money as a delayed gratification reward rather than spending what you earn now.