AVOID FINANCIAL MISTAKES WITH A

Discover moreUncover blind-spots to help you make better financial decisions

HOLISTIC VIEW OF

YOUR FINANCES

Everyone wants to achieve financial freedom

We all want to be able to meet our life goals over the course of our lifetime. We want to be able to say sayonara to our work and sip a cocktail while enjoying the sunset without any financial worries.

Financial goals mean different things to different people. For some, it could mean being able to afford a wedding of their dreams in the next 3 years. For others, it could mean being able to afford the purchase of one’s dream home; or being able to send their children to a foreign university for the best education. Lastly, it could mean having the desired retirement lifestyle without any more financial cares.

This desire for financial freedom drives us all to work hard, invest our hard-earned money with the hope that it grows sufficiently to meet all our financial goals.

How can we invest?

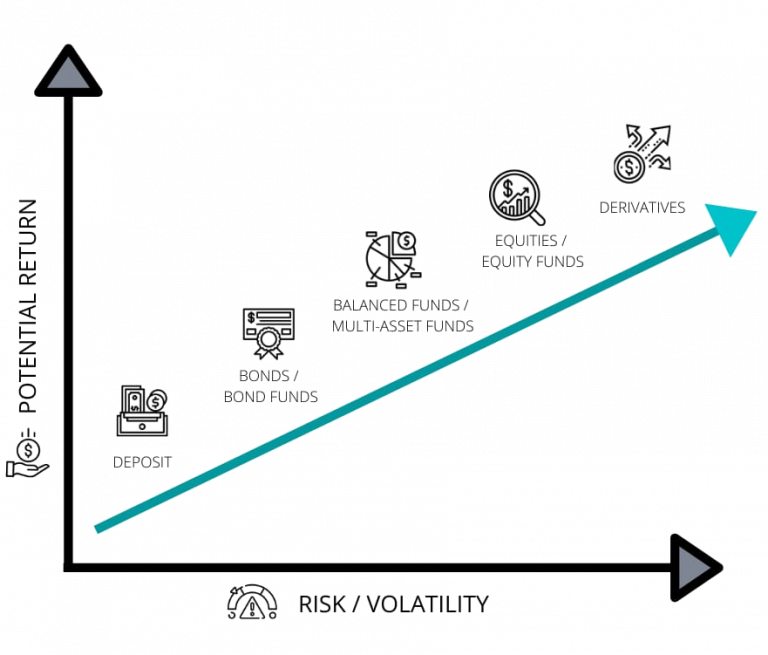

The need to grow investment returns drives us to explore all sorts of investment opportunities. Depending on one’s risk appetite, investors plough their hard earned money into tried and tested assets like property, shares or plain vanilla bank fixed deposits. For the more adventurous, they might venture into higher risk assets with the hope of chasing higher potential return. The less careful might stumble on a scam instead. But is aiming for the highest return the best investment approach?

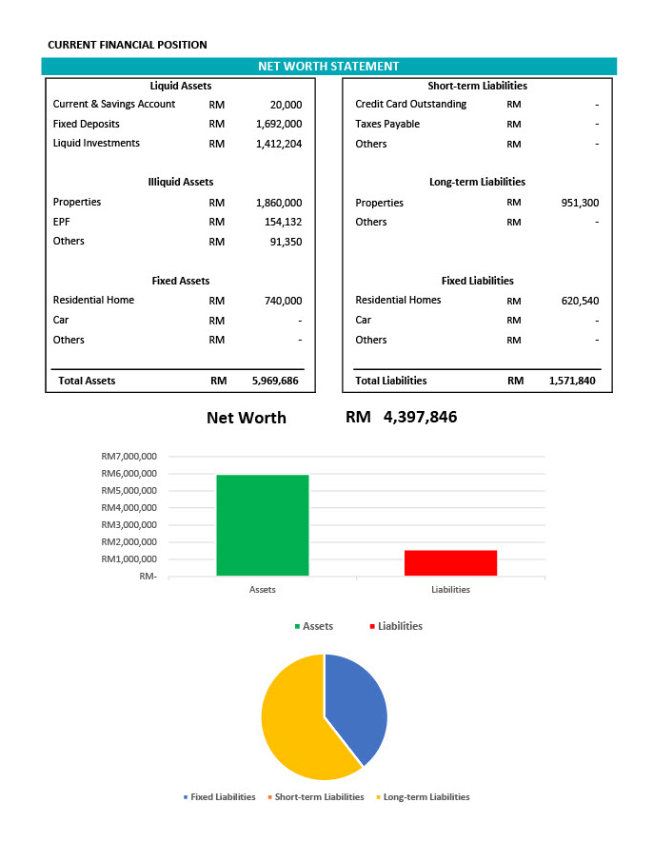

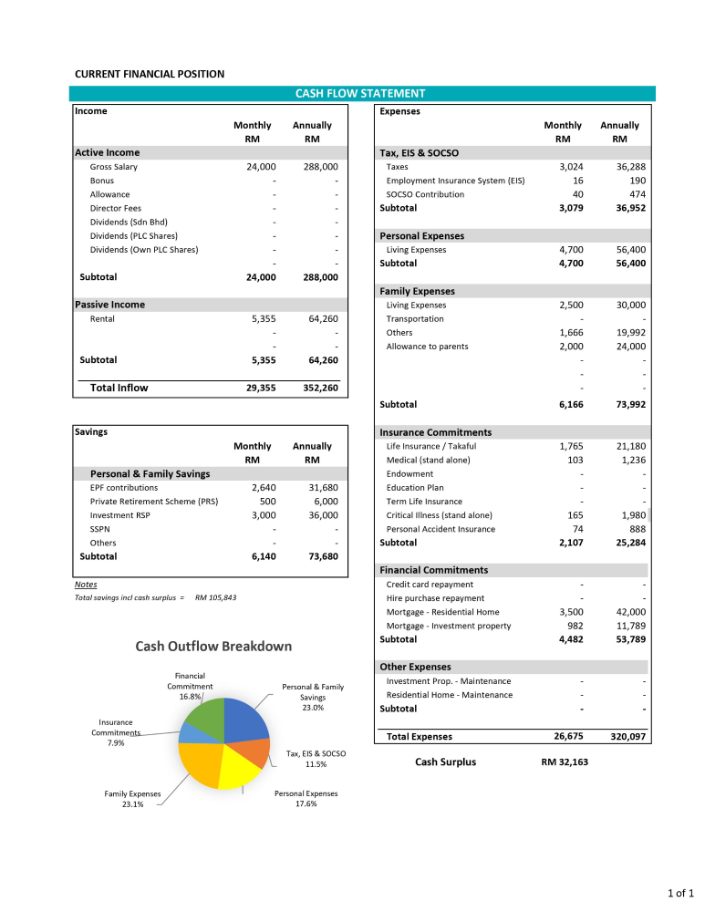

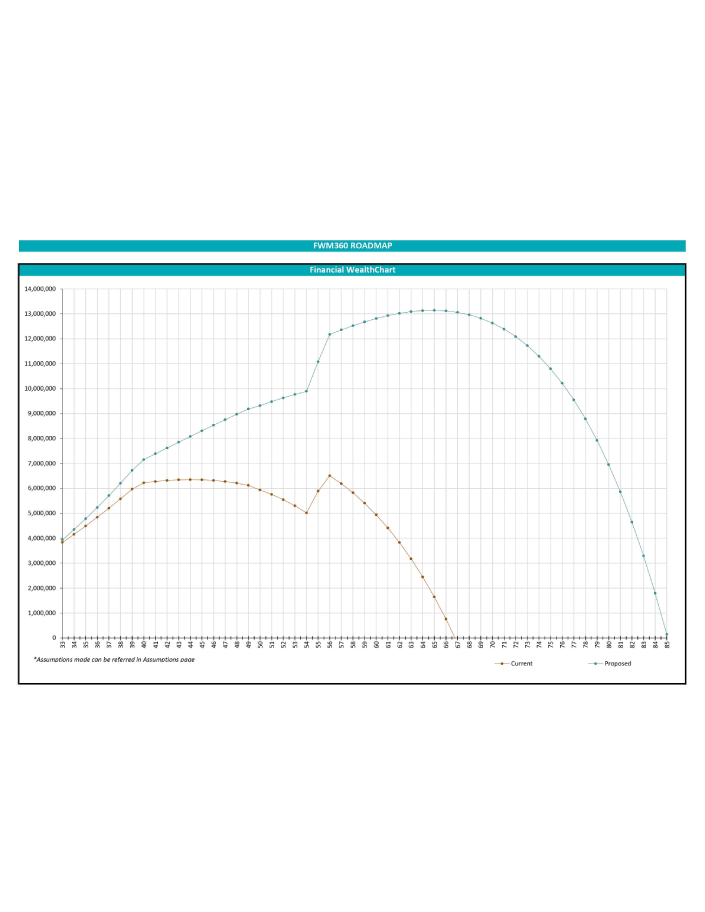

To meet our financial goals, we need to focus on growing our financial capacity – or simply put, our net worth. For those unfamiliar with this term, it just means the difference between the gross value of all our assets less the loans that we have. Our net worth is probably the single most important measurement of where we stand financially at any point of time.

Our approach to growing Net Worth

In trying to meet our financial goals to achieve our desired financial freedom, many focus on investing. Return on investment (ROI) is the common measure of success in investing. However, the downside of a single-minded focus on this measurement could result in investing without sufficient thought to the risks associated with the investments. So, is investment ROI the only way to grow your net worth?

There’s no denying that getting the optimal investment return on your hard-earned money is important in growing your net worth. But there’s more to it than that. Having assisted our clients over the years in their financial journey towards financial freedom, it’s our experience that there are 4 main factors to consider when you aim to grow your net worth effectively.

Our approach to growing Net Worth

In trying to meet our financial goals to achieve our desired financial freedom, many focus on investing. Return on investment (ROI) is the common measure of success in investing. However, the downside of a single-minded focus on this measurement could result in investing without sufficient thought to the risks associated with the investments. So, is investment ROI the only way to grow your net worth? There’s no denying that getting the optimal investment return on your hard-earned money is important in growing your net worth. But there’s more to it than that.Having assisted our clients over the years in their financial journey towards financial freedom, it’s our experience that there are 4 main factors to consider when you aim to grow your net worth effectively.

Growing Your Savings

Increase Our Return on Investment

Growing Your Savings

Increase Our Return on Investment

Reducing Financial Risks

Reducing Financial Costs

Reducing Financial Risks

Reducing Financial Costs

We help you gain a holistic view of your financial position to make better informed decisions

WHY FINWEALTH

One-Stop Solution Centre

Everything starts with a Plan and having a financial professional by your side will help you track your progress and make the right financial decisions to achieve your life goals.

Un-bias Financial Advice

We are an independent advisory firm who represents you and acts in your best interest, and not any product or platform provider.

Holistic View in All Areas of Your Personal Finance

Having a big-picture view of your situation and goals helps you make better financial decisions by optimising your financial resources more efficiently.

Focus on Growing Your

Net Worth

Tracking your progress not just on investment returns but growing your overall wealth as a whole.

Our approach to growing Net Worth

In trying to meet our financial goals to achieve our desired financial freedom, many focus on investing. Return on investment (ROI) is the common measure of success in investing. However, the downside of a single-minded focus on this measurement could result in investing without sufficient thought to the risks associated with the investments. So, is investment ROI the only way to grow your net worth?

There’s no denying that getting the optimal investment return on your hard-earned money is important in growing your net worth. But there’s more to it than that.Having assisted our clients over the years in their financial journey towards financial freedom, it’s our experience that there are 4 main factors to consider when you aim to grow your net worth effectively.