FEATURES

Intuitive features that

help you make your money grow

Growing Net Worth With A Plan

As they say, knowledge is power but knowledge without action is futile. Similarly, being aware that growing your net worth is important but not knowing how to go about doing it in a systematic and holistic manner may not help you achieve your financial goals.

Our approach to helping clients grow their net worth is simple. We recognise that growing net worth is a journey, as such we employ a broad-based financial planning process to help you get to your desired destination.

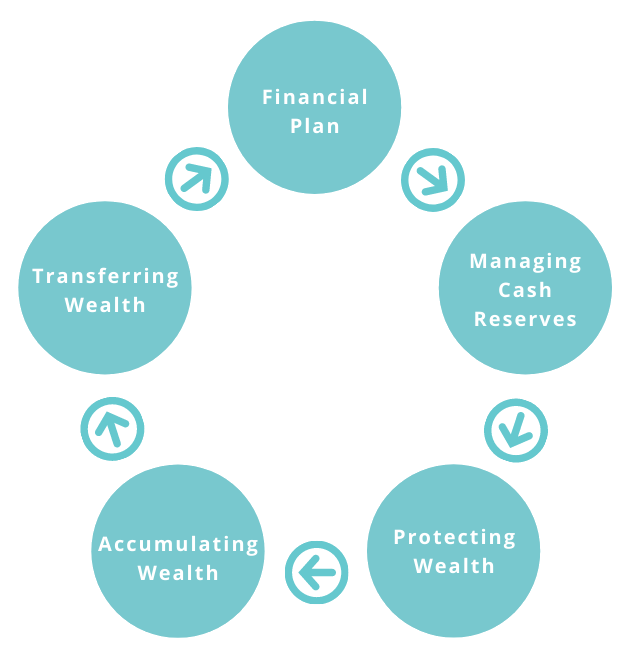

The Financial Planning Journey

The financial planning journey starts with a financial roadmap – an exercise to take stock of where you stand financially today, help you quantify where you want to be in the future in terms of your financial related goals and how to achieve them. Think of it as your personalized financial waze, empowering you to navigate through life with better foresight. The financial plan helps you ensure that your shorter-term goals do not get in the way of impacting the most important financial goal for us – enjoying our desired lifestyle throughout our retirement years.

Due to the uncertainties that we face in life, it’s always handy to have easy access to some liquid assets in case of financial emergencies. These should be set aside in safe assets that don’t fluctuate in value. As the trade-off for these low-risk investments is low returns, you should only aim to have sufficient cash reserves while excess amounts should be channeled to more productive investment opportunities. For working adults with a stable income, 6 months of expenses should suffice, however retirees should aim to set aside between 2-3 years of expenses as cash reserves for better peace of mind.

For many of us, increasing our financial assets is the main focus as we embark on our financial journey. It can’t be denied that growing our assets over our working careers is important to enable us to achieve our financial life goals. However, we also need to be mindful of the potential risks that we might face along this journey. This is where wealth protection comes in – safeguarding our ability to continue to grow our finances over time and safeguarding the assets accumulated against financial risks that might ruin us. To this end, choosing the appropriate policies for our protection is important to ensure that we have optimal level of the coverage needed for ourselves and our dependents at the right pricing so that we can continue to grow our assets.

As we embark on the journey to grow our net worth, it’s important to be mindful of the purpose for our investments. What are our financial goals and how much would these cost in the future? When we have clarity on these important factors, we’re in a better position to invest effectively. Being a proficient investor requires us to practice some key investment principles. Firstly, we need to invest based on the right strategic asset allocation – i.e. having the right of combination of low, moderate and high risk assets that reflect our risk profile and is able to potentially generate sufficient returns to help us grow our assets to achieve those financial goals.

Secondly when looking for investments, always consider investing in a diversified portfolio comprising of different asset classes (e.g. equities, bonds, REITs, commodities, etc.) in different geographies (not just Malaysia but in Asia, US, Europe and other developing countries) and different currencies. This way, you set yourself for better long-term risk adjusted returns instead finding yourself always looking for the next hot investment idea but risk getting caught should the tide turn.

Once invested, we need to actively manage the performance of those assets. This can be through portfolio restructuring (i.e. changing the underlying investments when required), portfolio rebalancing (i.e. selling assets that might have risen and purchasing the ones that are down; essentially applying the investment strategy of buying low and selling high), profit taking (i.e. taking some money off the proverbial investment table to preserve the gains) and reinvesting profit (i.e. taking advantage of market weakness to lower our investment cost).

We grow our assets over time with the hope of using those funds to attain our future financial goals. It’s our wish that we can continue to manage the transfer of assets when the time comes. However, what happens if we’re no longer able to do that in our own terms due to an unexpected medical condition or untimely demise? What if our assets are able to last beyond 2 generations - how do we safeguard and protect it for the benefit of future generations? To meet the financial planning goals we set for ourselves, we need to be prepared for these what-ifs. Effective wealth transfer process begins with a Will to capture your wishes in terms of how you want to distribute your assets when the time comes. It also enables you to state your preference for guardians (if you have minor children) or how you wish to stagger the distribution of your assets over time (via a testamentary trust). If you are concerned about distributing your assets quickly under certain trigger events to benefit yourself or your loved ones, a Trust might be an handy estate planning tool as well.

When you apply the financial planning process, 2 things will become evident over time. The operative word is that this is a “process” as such, a regular review of your implementation is necessary to ensure that you remain on your desired trajectory. Secondly, it’s more likely that your checkpoints and goals are in the future, as such things may change over time and you need to make some allowance for these changes. You need to “rinse and repeat” the process over time with an annual update to your financial plan and determine the required changes to implement in the coming year. By diligently adopting this on-going process, you can confidently move forward with clarity, confidence and control over your finances.

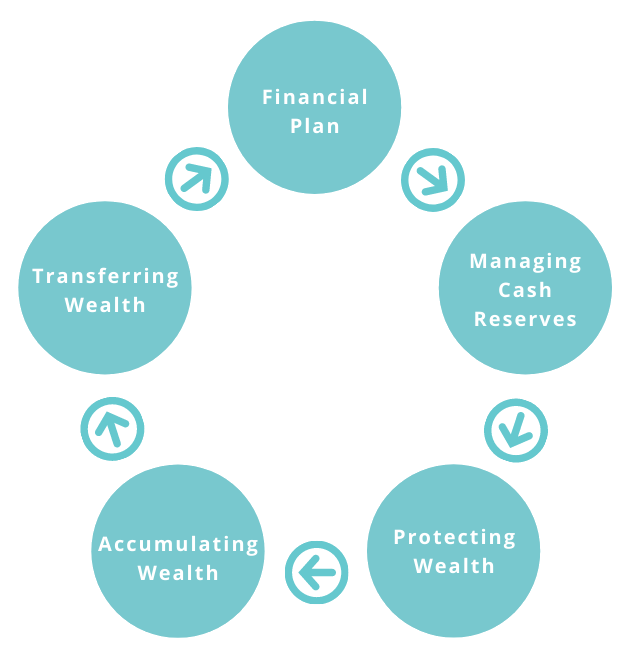

The Financial Planning Journey

The financial planning journey starts with a financial roadmap – an exercise to take stock of where you stand financially today, help you quantify where you want to be in the future in terms of your financial related goals and how to achieve them. Think of it as your personalized financial waze, empowering you to navigate through life with better foresight. The financial plan helps you ensure that your shorter-term goals do not get in the way of impacting the most important financial goal for us – enjoying our desired lifestyle throughout our retirement years.

Due to the uncertainties that we face in life, it’s always handy to have easy access to some liquid assets in case of financial emergencies. These should be set aside in safe assets that don’t fluctuate in value. As the trade-off for these low-risk investments is low returns, you should only aim to have sufficient cash reserves while excess amounts should be channeled to more productive investment opportunities. For working adults with a stable income, 6 months of expenses should suffice, however retirees should aim to set aside between 2-3 years of expenses as cash reserves for better peace of mind.

For many of us, increasing our financial assets is the main focus as we embark on our financial journey. It can’t be denied that growing our assets over our working careers is important to enable us to achieve our financial life goals. However, we also need to be mindful of the potential risks that we might face along this journey. This is where wealth protection comes in – safeguarding our ability to continue to grow our finances over time and safeguarding the assets accumulated against financial risks that might ruin us. To this end, choosing the appropriate policies for our protection is important to ensure that we have optimal level of the coverage needed for ourselves and our dependents at the right pricing so that we can continue to grow our assets.

As we embark on the journey to grow our net worth, it’s important to be mindful of the purpose for our investments. What are our financial goals and how much would these cost in the future? When we have clarity on these important factors, we’re in a better position to invest effectively. Being a proficient investor requires us to practice some key investment principles. Firstly, we need to invest based on the right strategic asset allocation – i.e. having the right of combination of low, moderate and high risk assets that reflect our risk profile and is able to potentially generate sufficient returns to help us grow our assets to achieve those financial goals.

Secondly when looking for investments, always consider investing in a diversified portfolio comprising of different asset classes (e.g. equities, bonds, REITs, commodities, etc.) in different geographies (not just Malaysia but in Asia, US, Europe and other developing countries) and different currencies. This way, you set yourself for better long-term risk adjusted returns instead finding yourself always looking for the next hot investment idea but risk getting caught should the tide turn.

Once invested, we need to actively manage the performance of those assets. This can be through portfolio restructuring (i.e. changing the underlying investments when required), portfolio rebalancing (i.e. selling assets that might have risen and purchasing the ones that are down; essentially applying the investment strategy of buying low and selling high), profit taking (i.e. taking some money off the proverbial investment table to preserve the gains) and reinvesting profit (i.e. taking advantage of market weakness to lower our investment cost).

We grow our assets over time with the hope of using those funds to attain our future financial goals. It’s our wish that we can continue to manage the transfer of assets when the time comes. However, what happens if we’re no longer able to do that in our own terms due to an unexpected medical condition or untimely demise? What if our assets are able to last beyond 2 generations – how do we safeguard and protect it for the benefit of future generations? To meet the financial planning goals we set for ourselves, we need to be prepared for these what-ifs. Effective wealth transfer process begins with a Will to capture your wishes in terms of how you want to distribute your assets when the time comes. It also enables you to state your preference for guardians (if you have minor children) or how you wish to stagger the distribution of your assets over time (via a testamentary trust). If you are concerned about distributing your assets quickly under certain trigger events to benefit yourself or your loved ones, a Trust might be an handy estate planning tool as well.

When you apply the financial planning process, 2 things will become evident over time. The operative word is that this is a “process” as such, a regular review of your implementation is necessary to ensure that you remain on your desired trajectory. Secondly, it’s more likely that your checkpoints and goals are in the future, as such things may change over time and you need to make some allowance for these changes. You need to “rinse and repeat” the process over time with an annual update to your financial plan and determine the required changes to implement in the coming year. By diligently adopting this on-going process, you can confidently move forward with clarity, confidence and control over your finances.

View More

View More

View More

As we embark on the journey to grow our net worth, it’s important to be mindful of the purpose for our investments. What are our financial goals and how much would these cost in the future? When we have clarity on these important factors, we’re in a better position to invest effectively. Being a proficient investor requires us to practice some key investment principles.

View More

Secondly when looking for investments, always consider investing in a diversified portfolio comprising of different asset classes (e.g. equities, bonds, REITs, commodities, etc.) in different geographies (not just Malaysia but in Asia, US, Europe and other developing countries) and different currencies. This way, you set yourself for better long-term risk adjusted returns instead finding yourself always looking for the next hot investment idea but risk getting caught should the tide turn.

Once invested, we need to actively manage the performance of those assets. This can be through portfolio restructuring (i.e. changing the underlying investments when required), portfolio rebalancing (i.e. selling assets that might have risen and purchasing the ones that are down; essentially applying the investment strategy of buying low and selling high), profit taking (i.e. taking some money off the proverbial investment table to preserve the gains) and reinvesting profit (i.e. taking advantage of market weakness to lower our investment cost).

We grow our assets over time with the hope of using those funds to attain our future financial goals. It’s our wish that we can continue to manage the transfer of assets when the time comes.

View More

Step 6: Review & Repeat

When you apply the financial planning process, 2 things will become evident over time. The operative word is that this is a “process” as such, a regular review of your implementation is necessary to ensure that you remain on your desired trajectory.

View More

Our Services

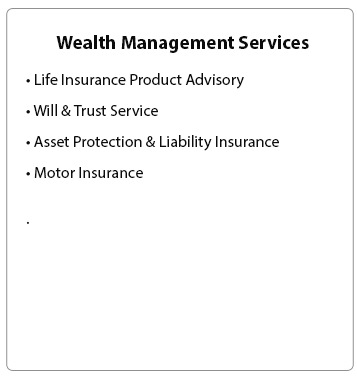

Wealth Management Services

- Life Insurance Product Advisory

- Will & Trust Service

- Asset Protection & Liability Insurance

- Motor Insurance

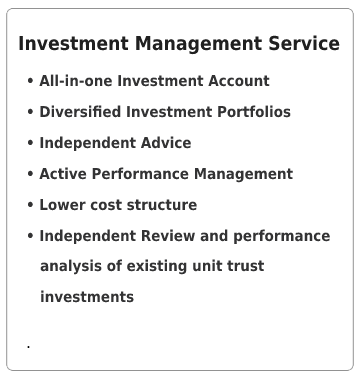

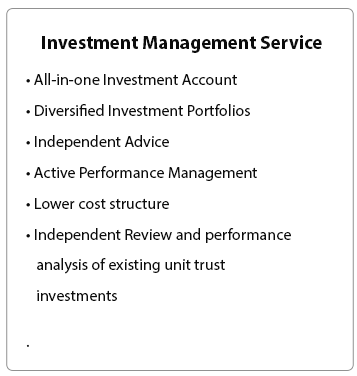

Investment Management Service

- All-in-one Investment Account

- Diversified Investment Portfolios

- Independent Advice

- Active Performance Management

- Lower cost structure

- Independent Review and performance analysis of existing unit

trust investments

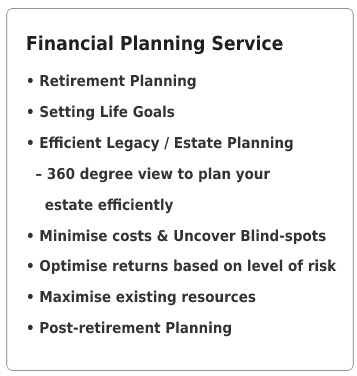

Financial Planning Services

- Retirement Planning

- Setting Life Goals

- Efficient Legacy / Estate Planning – 360 degree view to plan your estate efficiently

- Minimise costs & Uncover Blind-spots

- Optimise returns based on level of risk

- Maximise existing resources

- Post-retirement Planning

Wealth Management Services

- Life Insurance Product Advisory

- Will & Trust Service

- Asset Protection & Liability Insurance

- Motor Insurance

Investment Management Service

- All-in-one Investment Account

- Diversified Investment Portfolios

- Independent Advice

- Active Performance Management

- Lower cost structure

- Independent Review and performance analysis of existing unit trust investments

Financial Planning Services

- Retirement Planning

- Setting Life Goals

- Efficient Legacy / Estate Planning – 360 degree view to plan your estate efficiently

- Minimise costs & Uncover Blind-spots

- Optimise returns based on level of risk

- Maximise existing resources

- Post-retirement Planning

Lorem ipsum dolor sit amet,

consectetur adipiscing elit.

This is the heading

Wealth Management Services

- Life Insurance Product Advisory

- Will & Trust Service

- Asset Protection & Liability Insurance

- Motor Insurance

Investment Management Service

- All-in-one Investment Account

- Diversified Investment Portfolios

- Independent Advice

- Active Performance Management

- Lower cost structure

- Independent Review and performance analysis of existing unit trust investments

How do we do this? By constructing an asset allocation model to fit your individual risk profile. This will serve 2 purpose, manage your own level of fear/ greed and at the same time able to maximise your returns at a given level of risk. This way, we will be able to know how much of your wealth needs to be allocated to the low risk, medium risk and high-risk investments in order to provide you a good balance between maximising returns for a given level of risk.

It is proven that asset allocation and diversification are the key determinants of long term investment performance

How do we do this? By constructing an asset allocation model to fit your individual risk profile. This will serve 2 purpose, manage your own level of fear/ greed and at the same time able to maximise your returns at a given level of risk. This way, we will be able to know how much of your wealth needs to be allocated to the low risk, medium risk and high-risk investments in order to provide you a good balance between maximising returns for a given level of risk.

It is proven that asset allocation and diversification are the key determinants of long term investment performance

Financial Planning Service

- Retirement Planning

- Setting Life Goals

- Efficient Legacy / Estate Planning – 360 degree view to plan your estate efficiently

- Minimise costs Uncover Blind-spots

- Optimise returns based on level of risk

- Maximise existing resources

- Post-retirement Planning

Wealth Management Services

- Life Insurance Product Advisory

- Will & Trust Service

- Asset Protection & Liability Insurance

- Motor Insurance

Investment Management Service

- All-in-one Investment Account

- Diversified Investment Portfolios

- Independent Advice

- Active Performance Management

- Lower cost structure

- Independent Review and performance

analysis of existing unit trust

investments

Financial Planning Service

- Retirement Planning

- Setting Life Goals

- Efficient Legacy / Estate Planning – 360 degree view to plan your estate efficiently

- Minimise costs Uncover Blind-spots

- Optimise returns based on level of risk

- Maximise existing resources

- Post-retirement Planning

KEY FEATURES

All tools that you can imagine to manage your money and plan your budget in one place. It’s simple and intuitive

Share finances with partner

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat. Sed ultrices nisl velit, eu ornare est ullamcorper.

Manage your money from all over the world

Curabitur sed iaculis dolor, non congue ligula. Maecenas imperdiet ante eget hendrerit posuere. Nunc urna libero, congue porta nibh a, semper feugiat sem. Sed auctor dui eleifend, scelerisque eros ut, pellentesque nibh. Nam lacinia suscipit accumsan. Donec sodales, neque vitae rutrum convallis, nulla tortor pharetra odio, in varius ante ante sed nisi. Orci varius natoque penatibus et magnis dis parturient.

Saving plans that work

In condimentum maximus tristique. Maecenas non laoreet odio. Fusce lobortis porttitor purus, vel vestibulum libero pharetra vel. Pellentesque lorem augue, fermentum nec nibh et, fringilla sollicitudin orci. Integer pharetra magna non ante blandit lobortis. Sed mollis consequat eleifend. Aliquam consectetur orci eget dictum tristique. Curabitur sed iaculis dolor, non congue ligula. Maecenas imperdiet ante eget.

Personal support

Aliquam fringilla aliquam ex sit amet elementum. Proin bibendum sollicitudin feugiat. Curabitur ut egestas justo, vitae molestie ante. Integer magna purus, commodo in diam nec, pretium auctor sapien. In pulvinar, ipsum eu dignissim facilisis, massa justo varius purus, non dictum elit nibh ut massa. Nam massa erat, aliquet a rutrum eu, sagittis ac nibh. Duis dignissim mi ut laoreet mollis.